Introduction

Let me start with a truth I’ve seen play out countless times: businesses don’t fail because their teams aren’t working hard — they fail because they don’t track where that hard work goes.

The real difference often lies in whether your team’s hours are billable or non-billable. Misunderstand this distinction and you’ll end up with leaky invoices, frustrated clients, and burned-out staff. In fact, a study found that manual time tracking methods result in 1 out of every 5 billable hours being lost—that’s 20% of potential revenue gone before you even invoice your clients. Some studies even report losses as high as 40%, highlighting the urgent need for accurate tracking.

In this guide, I’ll break down billable vs non-billable hours, show you examples, share practical strategies, and even let you in on lessons I’ve learned from 15+ years of working with agencies, freelancers, and consultants. By the end, you’ll know exactly how to protect your billable time and use non-billable work wisely.

What Does “Billable or Non-Billable” Mean?

At its simplest:

- Billable hours are time you can invoice a client for — work that directly delivers value or a tangible output.

- Non-billable hours are necessary business activities that keep your operations running but aren’t charged to a client.

Sounds straightforward, right? In reality, this is where many teams stumble. Misclassifying just a few hours per week can quietly drain revenue without anyone noticing.

👉 Example from experience: In one agency I advised, client check-in calls were treated as non-billable “relationship-building.” Another firm billed those same calls as project management. Both approaches were defensible, but one firm left thousands of dollars on the table each month simply due to classification differences.

The key takeaway: it’s not just about “what feels billable.” It’s about aligning with your contract, project scope, and client expectations. Clear definitions prevent disputes, protect revenue, and make your team’s efforts visible and valued.

How to Spot the Difference: Quick Reference

| Task Type | Likely Billable? | Notes & Tips |

|---|---|---|

| Deliverables (designs, reports, code, documents) | ✅ Billable | Always link to the client’s approved scope. |

| Client meetings about project progress | ✅ Billable | Only if the meeting is aligned with agreed work. |

| Research or analysis tied to a client brief | ✅ Billable | Ensure it directly impacts deliverables or recommendations. |

| Internal company meetings | ❌ Non-billable | Staff huddles, HR, or strategy sessions are usually not chargeable. |

| Business development (pitches, proposals, networking) | ❌ Non-billable | These help the company grow but aren’t invoiced to clients. |

| Recruiting, onboarding staff | ❌ Non-billable | Part of operational overhead, not client work. |

| Training and professional development | ❌ Non-billable | Exceptions: if training is billable under contract. |

| Client emails outside scope | ⚖️ Grey area | Track separately — may justify invoicing if aligned with extra work. |

| Revision rounds not in contract | ⚖️ Grey area | Consider as add-ons; log separately for client approval. |

| Travel time | ⚖️ Grey area | Bill only if specified in contract. |

Rule of thumb: If the client sees a direct output or value, it’s likely billable. If it’s keeping your business running, it’s probably non-billable.

Why Correct Classification Matters

Properly classifying hours isn’t optional — it’s critical to profitability and operational clarity. Here’s why:

- Revenue forecasting: Underreporting billable hours creates “invisible leaks” that erode profits over time.

- Client trust: Transparent invoices reduce disputes and build credibility.

- Team fairness: If employees spend half their week on non-billable tasks, staffing, pricing, and workload need adjustment.

👉 From the field: At one agency I consulted, a mere 5% misclassification in hours translated to $250,000 in unbilled time over a year. The team wasn’t slacking — they were just labeling their hours incorrectly. Correct tracking revealed where processes needed adjustment and led to immediate improvements in billing and utilization.

How to Calculate Billable Time, Rates & Revenue

Calculating billable time isn’t rocket science, but if you want accurate invoices, predictable revenue, and fair client billing, consistency is everything. Let’s break it down step by step and add some real-world context.

Step 1: Track your time in precise increments

The foundation of billing accuracy is detailed time tracking. Most professionals use:

- 6-minute increments (common in law firms or professional services)

- 15-minute increments (common in agencies, consultants, and freelancers)

Why small increments matter: a 10-minute task may seem insignificant, but if it happens multiple times a day, misclassifying it can erase hundreds or even thousands of dollars annually.

Pro tip from experience: I’ve seen teams underbill more than $10,000 per year simply because 5–10 minute tasks were never logged or were lumped into non-billable time. Tracking each task precisely prevents that invisible revenue leak.

Step 2: Apply your hourly rate

Once your time is tracked, multiply it by your hourly billing rate. This is straightforward for most freelancers, but agencies or firms need to consider role-based rates:

- Senior consultant: $150/hour

- Junior consultant: $75/hour

- Administrative support: $50/hour

Example:

If a senior consultant logs 30 billable hours in a 40-hour week at $150/hour:

- Billable revenue: 30 × $150 = $4,500

Notice the difference if you misclassify even a few hours. Say 2 hours were wrongly logged as non-billable:

- Lost revenue = 2 × $150 × 52 weeks ≈ $15,600 per year, per employee.

That’s why accurate tracking isn’t optional — it’s a profit lever.

Step 3: Factor in utilization rate

Utilization rate measures how much of an employee’s time is actually billable versus total work hours. It’s a key metric for planning staffing and revenue.

Formula:

Utilization Rate (%) = Total Hours Worked/Billable Hours × 100

Example:

- Total hours worked in a week: 40

- Billable hours logged: 30

- Utilization = 30 ÷ 40 × 100 = 75%

If your team’s utilization is too low, even fully tracked hours won’t translate into expected revenue — it signals non-billable work is creeping in too much or projects are underpriced.

A healthy utilization rate is usually above 65%, with top teams aiming for 75% or more. Ideal rates vary by role and industry, so treat this as a benchmark.

Step 4: Adjust for role, project, or client variations

Not every hour is created equal. Some clients or projects allow for:

- Different billing increments: 6-minute vs. 15-minute blocks

- Premium rates for specialized services

- Blended rates for mixed-role teams

Example: For an agency project:

- 10 hours of senior strategy work at $150/hr = $1,500

- 5 hours of junior design at $75/hr = $375

- Total project billable revenue = $1,875

This helps in forecasting project profitability accurately.

Step 5: Always align billing increments with your contract

Contracts define what clients expect and will pay for:

- Some clients accept 15-minute rounded increments

- Others (e.g., law firms or consulting contracts) require exact 6-minute tracking

Pro tip: Make billing increments clear in the contract to avoid disputes later. A clear policy reduces client pushback and internal confusion.

Quick Checklist for Accurate Billable Calculations:

- Track every task in the agreed increment.

- Apply the correct hourly rate per role or service type.

- Multiply by utilization rate for revenue forecasting.

- Adjust for blended or premium rates if multiple roles work on the same task.

- Ensure your contract aligns with your time-tracking method.

Key takeaway: Billable calculations are more than math — they’re the backbone of fair pricing, predictable revenue, and client trust. Even small mistakes compound over time, so consistent tracking, clear contracts, and role-based rates are your best friends.

Tools & systems to track billable or non-billable time

- Time tracking tools: Karya Keeper, Hubstaff, or Productive let you tag time as billable or non-billable with a click.

- Project management integration: Link tasks directly to billing categories to avoid misclassifications.

- Policies: Define when to start/stop timers, who approves hours, and how short tasks are logged.

Policies & contract language that protect billable time

- Scope clarity: List what’s included and what’s out.

- Revision limits: Define how many are included before extra billing kicks in.

- Meeting rules: State which meetings are chargeable.

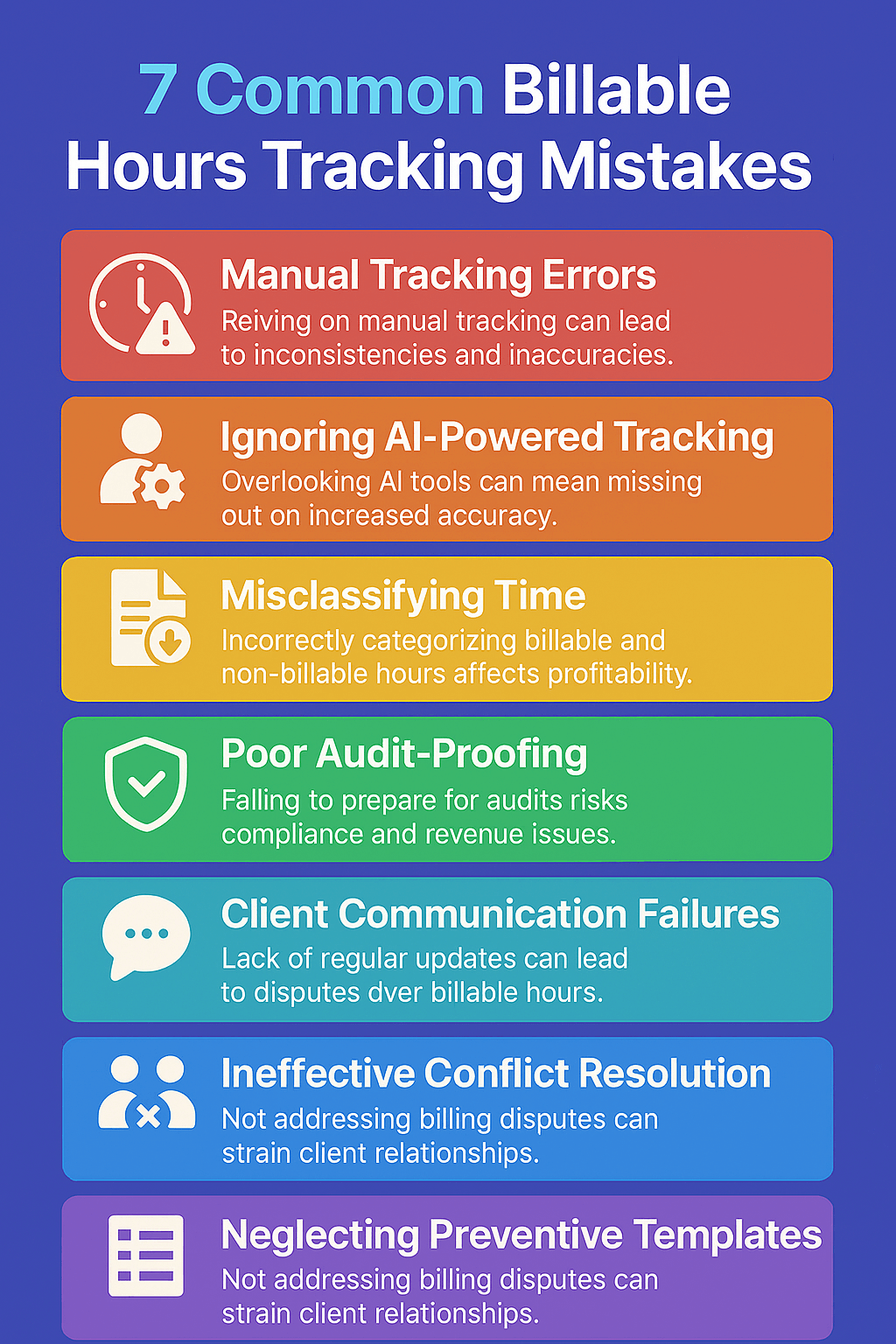

7 Common Billable Hours Tracking Mistakes (And How to Avoid Them)

- Manual Tracking Errors

Trying to reconstruct your week on Friday leads to inaccuracies. Typical underreporting: 15%. Consequences: lost revenue, client disputes. - Ignoring AI-Powered Tracking

Not using modern time tracking software that can automatically detect and classify activities reduces efficiency and accuracy. AI tools can improve tracking by 90%+. - Misclassifying Time

Mislabeling billable vs non-billable work can cause compliance issues and ethical problems. Keep detailed records and follow legal guidelines. - Poor Audit-Proofing

Lack of proper documentation makes billing vulnerable. Ensure date/time stamps, task descriptions, and approval processes are in place. - Client Communication Failures

Vague or delayed billing explanations can harm trust. Use clear line items, 5-minute bundling rules, and proactive communication. - Ineffective Conflict Resolution

Not addressing unusual billing weeks leads to disputes. Strategies: Billing preview emails, context calls, and clear documentation. - Neglecting Preventive Templates

Absence of structured templates for billing expectations, monthly summaries, and dispute resolution increases errors and confusion.

Strategies to Reduce Non-Billable Time and Increase Realization

Even the most disciplined teams rack up non-billable hours. That’s normal. The goal isn’t to eliminate every non-billable minute — that’s unrealistic — but to manage it strategically so it doesn’t eat into revenue or distort project planning. Over the years, I’ve found a few approaches that consistently work across freelancers, agencies, and consulting teams.

1. Batch administrative tasks

Small, scattered admin tasks are stealthy revenue killers. Answering emails, approving timesheets, or drafting status reports throughout the day might seem harmless, but they break focus and reduce billable output.

In fact, a study found that professionals spend 28% of their workweek on emails and administrative tasks, costing the US economy $1.3 trillion annually in lost productivity.

Actionable approach:

- Set specific time blocks for admin work — e.g., 9–10 AM and 4–4:30 PM.

- Encourage your team to close email tabs outside those windows.

- Automate recurring approvals where possible (e.g., leave requests, recurring invoices).

Insight: In one agency I led, batching admin tasks reduced “lost hours” by over 5 per week per employee — that’s 260 hours per year that could be redirected to client work or strategic initiatives.

2. Time-box internal meetings

Meetings are essential, but poorly managed ones are a huge source of non-billable time. Endless Monday check-ins, unscheduled brainstorms, or wandering agendas add hours of non-revenue work without delivering value.

Actionable approach:

- Cap meetings at 15–30 minutes unless necessary for deep work.

- Use pre-shared agendas to keep discussions focused.

- Schedule meetings back-to-back to prevent interruptions in billable time.

- Stand-up or asynchronous updates for recurring check-ins whenever possible.

Insight: In my experience, converting two weekly 1-hour meetings into three 15-minute stand-ups increased team utilization by nearly 10% while maintaining alignment.

3. Automate routine work

Repetitive tasks often classified as non-billable can be automated to save time and improve accuracy. Examples include:

- Invoice generation and reminders

- Recurring scheduling or calendar management

- Template-based reporting

- Standardized client communication

Automation frees up team hours for billable work and reduces errors that cause rework — a hidden non-billable cost.

4. Implement consistent time logging habits

One of the biggest hidden drains on revenue is inconsistent time tracking. Even when teams are productive, unlogged hours appear non-billable.

Real-life example: In my teams, we introduced a simple rule: log all time before leaving for the day. Within a month:

- Compliance jumped from ~40% to over 90%

- Reporting disputes between project managers and team members were cut in half

- Our projected billable revenue increased significantly without adding extra work

Actionable approach:

- Encourage daily logging, not weekly “catch-up” sessions

- Use timers integrated into project management or time-tracking tools

- Reward consistent tracking behavior with small recognition or incentives

5. Monitor and analyze non-billable trends

Understanding where non-billable hours accumulate is critical. Not all non-billable work is bad — training, internal knowledge sharing, and strategic planning are necessary — but unchecked, it can dilute your profitability.

Actionable approach:

- Run monthly reports to categorize non-billable hours by type (meetings, admin, training)

- Identify repeat offenders or recurring inefficiencies

- Adjust processes, redistribute workload, or schedule tasks differently based on the insights

Insight: In one consulting firm, a monthly non-billable report revealed that client onboarding was underdocumented and took 3–4 extra hours per project. By creating a standard onboarding template, they cut onboarding non-billable time by 50%, immediately improving billable utilization.

Key Takeaways

- Batch admin tasks to protect uninterrupted billable work

- Time-box meetings and use agendas or asynchronous updates

- Automate repetitive tasks to reduce wasted time

- Enforce consistent time logging habits

- Analyze non-billable trends to improve processes and efficiency

Even small changes in non-billable management can translate to thousands of dollars in additional revenue per employee per year. The goal isn’t perfection; it’s visibility, discipline, and smart process design.

Industry playbooks

- Freelancers: Keep it simple — use a timesheet template + fixed hourly increments.

- Agencies: Aim for 70–80% utilization across teams; package maintenance as retainers.

- Law firms: Stick to 6-minute increments, but watch for write-offs eating into realization.

- IT/MSPs: Bill ticket-based support; consider monthly caps to balance client trust and profitability.

Reporting & KPIs to Track

Tracking billable vs non-billable hours isn’t just about logging time — it’s about measuring efficiency, profitability, and team performance. If you ignore KPIs, you’re essentially flying blind, hoping your team’s hours translate to revenue. Over my 15+ years, I’ve seen even experienced teams leave thousands on the table simply because they didn’t measure the right things.

Here are the key KPIs you need to monitor regularly:

1. Utilization Rate

What it is: The percentage of total hours worked that are billable.

Utilization Rate (%) = Total Hours Worked/Billable Hours × 100

Why it matters: Utilization shows how effectively your team is converting working hours into revenue.

Example:

- Total hours worked in a week: 40

- Billable hours logged: 28

- Utilization = 28 ÷ 40 × 100 = 70%

A low utilization rate might indicate too much internal work, inefficient processes, or overstaffing.

Pro tip: Track utilization weekly to spot trends early rather than waiting for monthly or annual reviews.

2. Realization Rate

What it is: The percentage of billable hours actually invoiced and collected.

Realization Rate (%) = Billable Hours Invoiced/Billable Hours Logged × 100

Why it matters: Even if your team logs hours perfectly, clients may dispute charges, or work might get written off. Realization rate ensures logged time is actually monetized.

Example:

- Billable hours logged: 30

- Hours successfully invoiced: 27

- Realization = 27 ÷ 30 × 100 = 90%

Actionable tip: Investigate why write-offs or disputes happen — maybe your scope is unclear, or small tasks aren’t documented properly.

3. Billable % of Time per Role or Team

What it is: Measures how much time each role contributes to billable work.

Why it matters: Not all roles are expected to be 100% billable. For example:

- Consultants/analysts: 70–85%

- Admin/support staff: 20–40%

- Team leads/project managers: 50–70%

Pro tip: Compare actual billable % against expected targets to identify overstaffing, underutilization, or training gaps.

4. Write-offs

What it is: Hours that were billed but had to be discounted or not invoiced.

Why it matters: Write-offs indicate areas where your processes, contracts, or client expectations need tightening.

Example:

- Logged billable hours: 200 per month

- Written off hours: 10

- Write-off rate = 10 ÷ 200 × 100 = 5%

Insight: In one of my agency audits, write-offs were consistently hidden in “miscellaneous billing adjustments.” Once we tracked them transparently, we reduced write-offs by 50% within 3 months by standardizing contracts and clarifying scope.

5. Other useful KPIs to consider

- Average billable rate per employee: Helps compare team contribution and set realistic pricing.

- Non-billable trend by category: Understand if internal meetings, training, or admin are eating too much time.

- Project profitability: Billable hours × rate minus project costs = true margin.

Actionable Tip: Build a Dashboard

Instead of reviewing spreadsheets once a month, create a dashboard that shows KPIs in real-time or weekly:

- Utilize charts for utilization trends per team

- Highlight low realization or high write-offs

- Break down billable vs non-billable hours by project, client, and role

Why this works: Early visibility allows you to correct course before revenue is lost, not after year-end.

Insight: KPIs aren’t just numbers — they’re your early warning system. Weekly visibility keeps your team focused, ensures accurate billing, and helps you make smarter decisions about staffing, pricing, and processes.

Conclusion

Getting billable vs non-billable hours right isn’t just about filling out timesheets — it’s about building a fair, profitable, and sustainable business model. When your team knows what counts as billable, tracks it accurately, and aligns it with contracts and tools, you create clarity for everyone: clients, staff, and management.

Here’s a simple roadmap to make it stick:

1. 30 days – Run a time audit

- Track every hour to see where non-billable work is creeping in.

- Identify patterns and hidden revenue leaks.

2. 60 days – Update contracts and internal policies

- Clearly define what’s billable and non-billable.

- Standardize billing increments and approval processes.

3. 90 days – Implement dashboards and set targets

- Monitor utilization, realization, and write-offs weekly.

- Use the insights to optimize staffing, pricing, and project planning.

By following this 30/60/90 framework, you won’t just protect your billable hours — you’ll turn non-billable time into a strategic growth engine.

Parting advice from experience: Small, consistent adjustments in how you track, report, and manage hours compound over time. Invest a little effort upfront, and your team, your clients, and your bottom line will all thank you.

FAQs

Billable hours are time you can charge a client for, tied directly to deliverables or client work. Non-billable hours are internal tasks, admin work, training, or activities not directly invoiced to the client.

Common examples include internal meetings, company training, reporting, administrative tasks, or business development work. These keep your business running but aren’t invoiced to clients.

Yes, if your contract allows. Many teams bundle short tasks into standard increments (e.g., 15 or 30 minutes) to make invoicing consistent and clear.

Track daily if possible, and audit at least quarterly. Teams scaling rapidly may benefit from monthly audits to identify leaks and improve utilization.

Utilization measures the percentage of total hours that are billable. Realization measures how much of that billable time is actually invoiced and collected. Both help monitor profitability and efficiency.